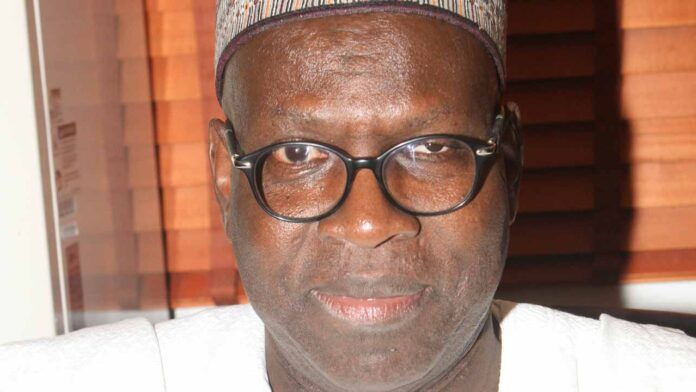

Mr Abdullahi Attah, the Executive Chairman, FCT Internal Revenue Service (FCT-IRS) says there can be no better diversification of economy than through taxation.

Attah said this in Abuja on Wednesday.

He said taxation was a major means of raising funds for government’s expenditure hence the need for responsible government to take that seriously.

He said many developed countries of the world depended on tax to generate revenue for development projects.

“When people pay tax, they feel a lot of pains because they are not seeing any direct benefits; to them they don’t see the military protection or police protection as well as infrastructure and other benefits to them. The fact is that they may enjoy them because these are the things that must necessary be provided. Country like Norway that produces a lot of oil depends on taxation to survive; it keeps its oil in Sovereign Wealth for a rainy day. In Rwanda too, it has been living on taxation and Nigeria itself during regional government in 1950s and 60s, all the regions were depending on taxation. When oil came and then we started depending on it as if it is something that will last. It will finish; we must necessarily go back to taxation”.

Attah disclosed that the service had decided to step down enforcement on non-filing of tax returns by taxpayers because of COVID-19.

He said every taxpayer was expected to file his or her tax returns by March 31 of every year but due to the pandemic, the FCT-IRS had given them enough time to do so.

According to him, in spite of the time given, some people have not filed their annual tax returns to the service.

He urged taxpayers who had not filed their tax returns to do so in the FCT-IRS offices nearest to them. (NAN)